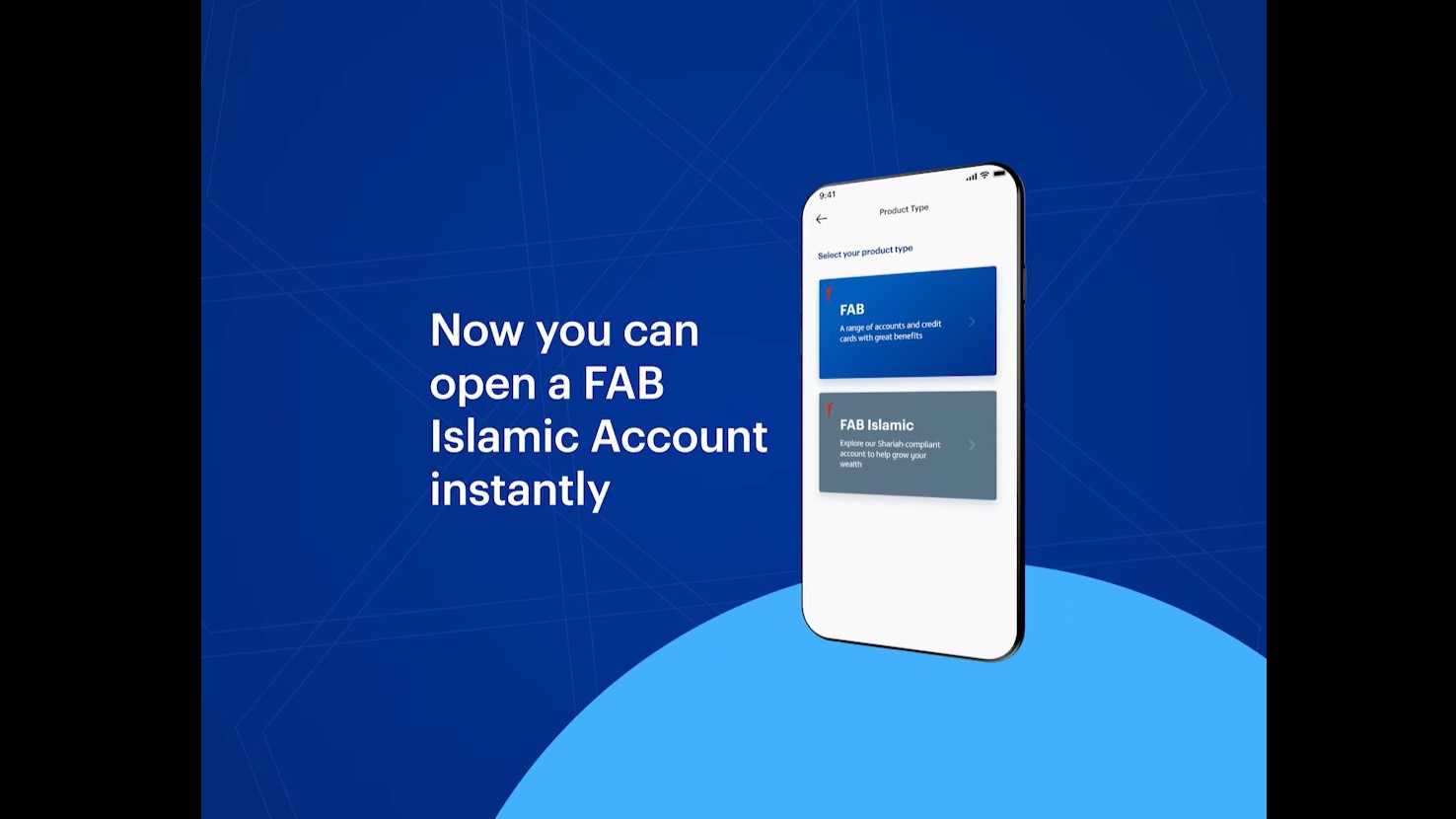

How to Open a FAB Islamic Savings Account

The process of opening a FAB Islamic Savings Account has become exceptionally convenient for customers. You can establish your FAB Islamic Savings Account through an online procedure that eliminates the need to visit bank branches.

You can start using FAB Islamic banking services right after opening your account through the First Abu Dhabi Bank Mobile App by following an easy step-by-step process. This instruction guides users through the complete procedure to establish their FAB Islamic Savings Account with speed and effectiveness.

Benefits of a FAB Islamic Savings Account

Multiple benefits come with opening a FAB Islamic Savings Account for customers, including:

- Shariah-compliant banking – The account operates under Islamic banking principles.

- Convenience – Open your account anytime, anywhere using the FAB Mobile App.

- No branch visits required – Complete the entire process online.

- Free Islamic debit card – Enjoy seamless transactions with a complimentary debit card.

- Airport lounge access – Get access to airport lounges across the region.

Steps to Open a FAB Islamic Savings Account

The procedure to open your FAB Islamic Savings Account requires the following steps:

Step 1: Download the FAB Mobile App

Customers need to obtain the FAB Mobile App through either the App Store or Google Play Store. You can access the downloading link for the FAB Mobile App at Download the FAB Mobile App.

Step 2: Select the Account Type

You can start using the FAB Mobile App after completing its installation process:

- Open the app to access FAB Islamic through its available menu options.

- Start an application process by selecting Islamic Current Account from the available options.

Step 3: Enter Your Information

Enter necessary information into specific sections of the provided fields, including:

- Full name

- Date of birth

- Contact information (email and phone number)

Step 4: Verify Your Identity

You will get the verification code through both email and mobile that are registered to your account. Move forward by entering this code into the verification field which has been allocated.

Step 5: Scan Your Emirates ID

Access the scanning function of the app to scan your Emirates ID. Double-check that the entered information matches the correct details for verification verification.

Step 6: Complete Additional Information

Submit all additional information which the bank asks for through its requests, such as:

- Employment details

- Source of income

- Address

Step 7: Accept Terms and Conditions

The application process requires you to review and accept the Customer Information Declaration in order to finish your application.

Step 8: Confirmation and Account Activation

After details submission you will get a confirmation message from the system. Your FAB Islamic Savings Account will receive activation shortly after which it will become usable immediately.

Frequently Asked Questions (FAQs)

What are the requirements to open a FAB Islamic Savings Account?

To open a FAB Islamic Savings Account, you need to meet the following requirements:

- A valid Emirates ID

- A registered mobile number and email address

- Basic personal details including full name, date of birth, and employment details

- A compatible smartphone to install and use the FAB Mobile App

Can I open a FAB Islamic Savings Account without visiting a bank branch?

Yes, the entire process is fully digital and can be completed through the FAB Mobile App. You do not need to visit a bank branch at any stage of the account opening process.

How long does it take to activate my FAB Islamic Savings Account?

Once you have successfully completed the registration process, including identity verification and document submission, your FAB Islamic Savings Account will be activated almost instantly. You will receive a confirmation message upon activation.

What benefits do I get with a FAB Islamic Savings Account?

Opening a FAB Islamic Savings Account comes with multiple benefits, including:

- Shariah-compliant banking

- A free Islamic debit card

- Instant access to banking services through the FAB Mobile App

- Airport lounge access across the region

- No requirement for branch visits, making the process convenient and efficient

Conclusion

Through the FAB Mobile App users can now open a FAB Islamic Savings Account in a convenient and easy manner. All banking and debit card services alongside airport lounge privileges under Shariah law become available through FAB Mobile App without requiring any physical visits to bank locations. Simply follow the provided instructions to begin banking using convenient methods.

Additional details regarding FAB Islamic Banking are available at the official section of the website or through the FAB Mobile App which will guide you into seamless banking operations.