Minimum Credit Score for Personal Loan in UAE

A personal loan application in the United Arab Emirates requires a credit score as one of its essential factors. Banks together with financial institutions leverage the three-digit number to determine the creditworthiness and debt repayment capacity of loan applicants.

This piece discusses the necessary personal loan credit score for UAE applications alongside its significance along with methods to boost your rating for better loan approval opportunities.

What Is the Minimum Credit Score for a Personal Loan in the UAE?

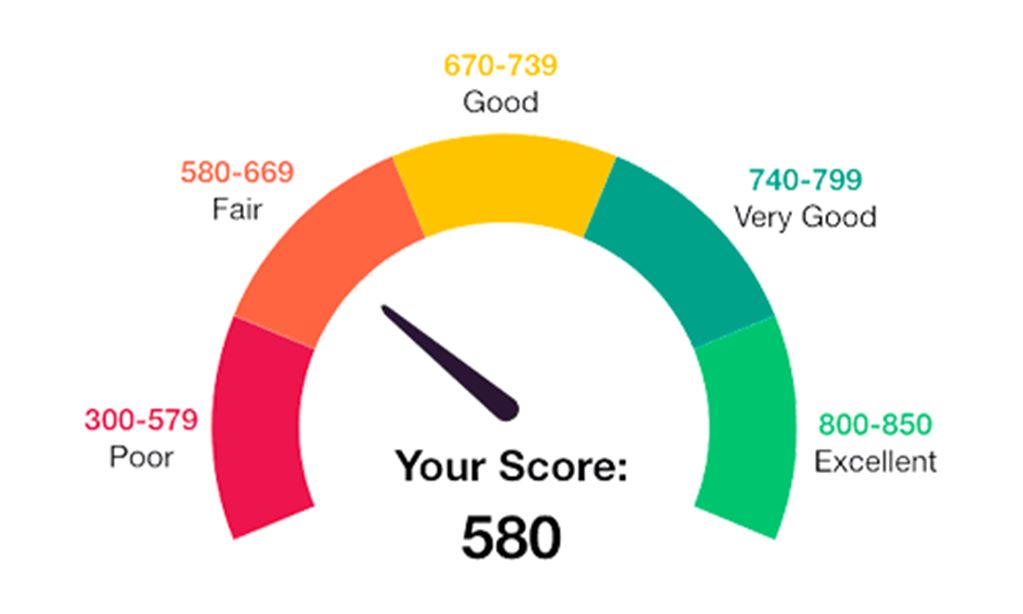

Personal loan applicants in the UAE need to demonstrate a credit score of at least 580 for approval. Although it serves as the baseline requirement borrowers with enhanced credit scores gain access to superior interest rates and superior loan terms. Banks choose individuals with good and excellent credit scores because such borrowers demonstrate less risk of default.

Why Is Your Credit Score Important for Loan Approval?

The financial details you have accumulated form your credit score which affects your ability to take out loans. Here’s why it is important:

- Loan Approval: Banks together with financial institutions base their loan approval decisions on your credit score to evaluate your repayment capabilities.

- Interest Rates: A strong credit score permits borrowers to obtain lower interest rates that decrease their borrowing costs.

- Loan Terms: Better credit scores enable borrowers to achieve bigger loan amounts together with flexible payment terms.

- Financial Reputation: The financial reputation of borrowers improves through good credit scores which makes it simpler to obtain loans in the future.

How Is Your Credit Score Calculated in the UAE?

The Al Etihad Credit Bureau (AECB) functions as the authority that creates credit scores in the UAE. The AECB obtains financial data from banks credit institutions together with telecommunication companies to generate your credit score. Your creditworthiness depends on your score which falls within the 300 to 900 points range.

Your credit score depends on multiple factors which are:

- Payment History: The timely repayment of loans together with credit card bills enhances your credit score.

- Outstanding Debt: Higher amounts of debt in your account will result in a lower credit score.

- Credit Utilization Ratio: An excessive credit utilization ratio will decrease your credit score.

- Returned Cheques: Your credit score will experience major damage when you make payments using returned checks or when you have checks that bounce or payments that miss.

- Credit Age: The duration of your credit history affects your score evaluation through Credit Age.

What Is Considered a Good Credit Score in the UAE?

The credit score scale will help you determine where you stand right now:

| Credit Score | Rating |

|---|---|

| Above 731 | Excellent |

| 680 – 730 | Good |

| 620 – 679 | Fair |

| 580 – 619 | Poor |

| Below 580 | Very Poor |

A minimum credit score of 650 ensures better opportunities to obtain personal loans.

How to Check Your Credit Score in the UAE

You can access your credit score by using the services of Al Etihad Credit Bureau (AECB). Here’s how:

- Visit the AECB website or download the AECB mobile app.

- Log in using your Emirates ID.

- Select the “Get Credit Report” option.

- Pay the required fee (currently AED 84).

- Download and review your credit report.

Before you file a loan application you must check your credit score because it shows issues that could impact the outcome of your application.

Tips to Improve Your Credit Score

A credit score under 580 makes it difficult to obtain personal loans. Several steps exist to enhance your credit score as follows:

- Pay Bills on Time: Every payment of credit cards loans and utility bills must be completed on schedule.

- Reduce Credit Card Utilization: The ratio between your credit limit and usage should stay under 30%.

- Avoid Multiple Loan Applications: Your score becomes negatively affected by the practice of applying for multiple loans at the same time.

- Settle Outstanding Debts: Crop all past-due debts by making full payments then steer away from issuing bad checks.

- Increase Your Credit Age: Extending your credit age requires keeping past accounts active to demonstrate longer borrowing experience.

- Monitor Your Credit Report: Regular monitoring of your credit report through the AECB allows you to detect errors so you can dispute them properly.

Frequently Asked Questions (FAQs)

What Is the Minimum Credit Score Required for a Personal Loan in the UAE?

A minimum credit score of 580 is required to qualify for a personal loan in the UAE. However, individuals with a higher credit score, preferably above 650, have better chances of securing loans with lower interest rates and more favorable terms.

How Can I Check My Credit Score in the UAE?

You can check your credit score through the Al Etihad Credit Bureau (AECB) by following these steps:

- Visit the AECB website or download the AECB mobile app.

- Log in using your Emirates ID.

- Select the “Get Credit Report” option.

- Pay the applicable fee (currently AED 84).

- Download and review your credit report.

What Factors Affect My Credit Score in the UAE?

Your credit score is determined based on several factors, including:

- Payment History: Timely repayment of loans and credit card bills boosts your score.

- Outstanding Debt: High levels of unpaid debt negatively impact your score.

- Credit Utilization Ratio: Using too much of your credit limit can lower your score.

- Returned Cheques: Bounced or missed payments significantly harm your credit rating.

- Credit Age: A longer credit history demonstrates responsible borrowing behavior.

How Can I Improve My Credit Score for a Personal Loan?

To enhance your credit score and increase your chances of loan approval, follow these steps:

- Make timely payments on all credit obligations, including loans and bills.

- Keep credit utilization below 30% to maintain a good score.

- Avoid multiple loan applications, as frequent credit inquiries can lower your score.

- Clear outstanding debts and avoid issuing bad cheques.

- Monitor your credit report regularly through the AECB to identify and rectify any errors.

Conclusion

To secure a personal loan in the UAE having a credit score of 580 or higher is necessary while high scores will enhance both your approval odds and the conditions of the loan. Proper financial obligation management will enhance your credit score which allows you to obtain loans with desirable conditions. Before applying for personal loans you must check your credit score to improve it if necessary.